Our Multi-Asset approach

Asset allocation constitutes the most important step in constructing investment portfolios; it has been shown as accounting for more than 90% of the variability in portfolio performance over time.

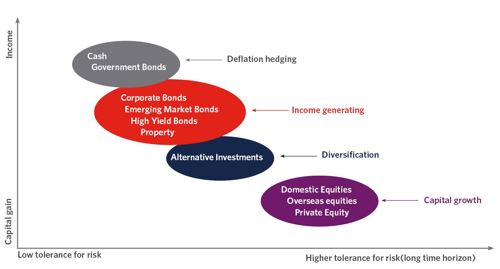

Asset classes such as equities, bonds and cash have different characteristics meaning that they respond differently to changing economic scenarios. These differences allow for the creation of multi-asset portfolios with complementary holdings that create optimised risk and return profiles.

Defining asset classes

Capital preservation assets

These are assets which provide protection during periods of market volatility, usually by virtue of their more predictable return streams and security of capital. Under normal circumstances, the stabilising influence of these assets comes at the opportunity cost of low relative returns. However they perform strongly relative to other assets in times of financial crisis or in deflationary conditions. Examples include cash and government bonds.

Income generation assets

These assets generally deliver the majority of their returns through income payments. Typical assets include property, investment grade corporate bonds and high yield bonds. Under specific circumstances convertible bonds also provide attractive coupon payments, whilst keeping track with equity market performance to a lesser extent.

Capital growth assets

These assets generate a large proportion of their returns through increases in prices (capital growth), but in some cases may also provide meaningful income as well. Typical assets include equities – both in developed and emerging markets.

Alternative assets

These are investments into assets which tend to exhibit a particularly low correlation of returns to other traditional asset classes. When combined in portfolios containing other assets they can sometimes provide an important diversification benefit and stability in periods of financial turmoil. Risk premia and arbitrage bond strategies would be included in this category, as well as precious metals and commodities.