At Momentum, we have leveraged our investment expertise and resources to deliver a truly focused outcome-based investment philosophy.

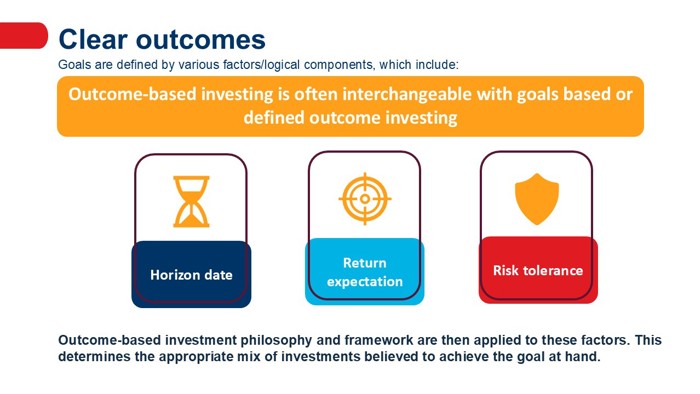

The philosophy is both simple and compelling in taking clearly defined steps in asset allocation, risk mitigation, and investment selection to increase the probability of delivering the investment outcome over a defined time horizon. Our aim is to smooth the investment journey towards the outcome and in doing so keeping clients invested over all market conditions.

The investment outcome guides our approach in determining the optimal strategic asset allocation. We assess asset classes both in the context of their potential to deliver on the investment objective over the desired time horizon and also the risk of short-term drawdowns, with the aim of making the journey for the end client as palatable as possible.

We use optimisation process to derive the appropriate strategic asset allocation that has the best probability of delivery on the desired outcome by focusing on preferences such as:

-

Maximising the probability of achieving the target,

-

Minimising the risk of falling meaningfully short of the target at the end of the investment horizon,

-

Minimising the risk of negative absolute returns over 12 months, and

-

Minimising the probability of experiencing a large drawdown over a 12-month period.

Such an optimisation process allows to significantly improve the risk-return characteristics of a portfolio, by expanding the universe of available asset classes, harvesting diversification benefits and reducing portfolio risk without giving up expected returns.

The funds' tactical asset allocation is actively managed and reflects Momentum's views on asset classes, regions and currency.