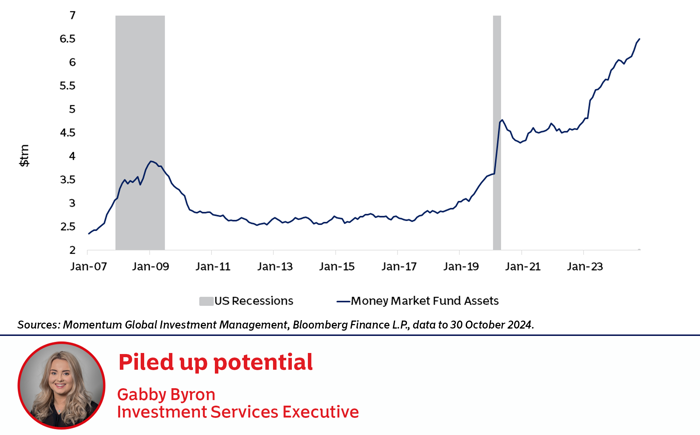

What this chart shows

This chart shows the total assets in US money market funds from 2007 through to October 2024, showing a steep increase towards these cash-like investments. Money market funds hold highly liquid, short-term government securities, offering a safe, yield-generating option for investors. As at end October 2024, assets in these funds have surpassed $6.5 trillion - $200bn higher than just before the Fed’s recent 50bp rate cut, and nearly doubling since pre-pandemic levels. The sharp rise has been driven by both monetary and fiscal responses to the pandemic and then elevated by higher interest rates, attractive yields and economic uncertainty. Over the last 18 months, reinvestment into these funds has also contributed to their expansion.

Why this is important

Earlier this year, we speculated that a rate cut from the Federal Reserve could be a trigger for investors to move assets from money market funds into riskier assets. However, after the Fed’s 50bp rate cut in September, money market assets have continued to increase. This suggests that other factors are at play, such as election-driven caution as we now approach the US presidential election, leaving investors in a wait-and-see mode regarding potential policy outcomes and how these could affect markets. In addition, with the next Federal Open Market Committee meeting approaching on 7 November, the Fed’s decision will be crucial. Since the September cut, data has generally come in stronger than expected, with Core CPI picking up slightly. If the Fed holds rates steady, yields on money market funds will remain compelling, likely keeping cash parked in these low-risk assets. A cut, however, particularly if it’s another 50 basis points, could potentially prompt a gradual reallocation back into riskier assets. The timeline and extent of future cuts remains uncertain given ongoing inflation and economic resilience and as we near year-end, the unprecedented level of money market assets represents a substantial amount of dry powder on the sidelines, poised to potentially flow back into other asset classes. Yet, if investors wait until rates fall further and other markets begin to rally in anticipation, there’s a risk of missing out on early gains.

Global markets were mixed at the end of October, impacted by inflationary pressures, cautious central bank moves, and regional fiscal policies.

-

The S&P 500 fell 0.9% as mixed corporate earnings reports and uncertainties around future Federal Reserve rate cuts and pending US Presidential Elections kept markets volatile

-

Treasury yields remained high, with the 10-year yield above 4.0%, influenced by sustained inflationary pressures despite the Fed’s September rate cut. Core inflation remains stubborn, posing challenges to potential rate adjustments

-

October’s labour data was robust, with strong job gains and wage growth providing economic resilience but complicating inflation management efforts

-

UK markets reacted negatively to Chancellor Rachel Reeves' budget, which outlined increased spending and borrowing, causing a bond sell-off and driving down gilt prices

-

UK equities declined as investors weighed the impact of higher taxes and borrowing on long-term growth prospects. The pound faced volatility amid concerns over inflation risks driven by increased fiscal stimulus

-

The UK budget’s planned borrowing raised inflationary fears, with economists expecting the Bank of England to navigate cautious rate cuts to counterbalance stimulus without fuelling further inflation with the market pricing in a 90% probability of 25bps of cut this week

-

European stocks struggled, as the ECB's cautious rate-cut strategy weighed on investor sentiment

-

The Eurozone posted a Q3 growth rate of 0.4%, though inflation ticked up to 2.0% in October. Energy costs and core inflation, especially in services, remain key concerns for the ECB

-

Europe’s manufacturing sector, particularly in Germany, continued to contract, reflecting ongoing challenges that could signal a broader economic slowdown

-

Germany narrowly missed recession with Q3 GDP up 0.2% QQ. Above consensus for a 0.1%qq contraction so Germany avoids recession after -0.1%qq in Q2

-

Japanese equities gained, 1.0% as the Bank of Japan (BoJ) maintained its accommodative policies amid domestic political shifts. Despite inflation at 1.8% in Tokyo, the BoJ has held its stance, signalling potential future rate hikes if conditions improve

-

Chinese equities declined despite modest economic improvements, with PMI data showing manufacturing activity expanding slightly. Persistent real estate issues and weaker-than-expected consumer demand held back gains

-

While some commodity-exporting countries benefited from higher prices, recession fears, inflation, and political instabilities in places like Argentina and Brazil contributed to volatility across emerging markets